How to Get a Car When You Re Poor

How and why driving a new car is keeping you poor, and how driving free cars for the rest of your life puts you on track to accumulate significant wealth.

In this article I'm going to make the case that most people should never buy a new car, because the payment is preventing you from accumulating wealth, and because in three short years you can pay CASH for a really nice car that you own free and clear. You can create the equivalent of a Free Car Money Tree that buys you a nearly new car every three or four years. Seriously.

I DON'T HAVE A CAR PAYMENT

I'm married with 4 kids. With 4 cars in our driveway none of us have car payments because we all drive Hoopdies. What's a hoopdie?

- A Jalopie.

- A Beater.

- A Boneshaker.

- A Rust bucket.

- A POS.

While I'm exaggerating to get your attention - none of our cars are jalopie rust buckets (well, the 16 year old's first car is pretty much a jalopie) - chances are pretty good that your car is newer and nicer than any of our cars. Prettier. More comfortable.

I'm going to talk about all the less obvious benefits of driving hoopdies below.

But let's first talk about the obvious benefits of owning a new car:

- Everything just works.

- The warranty covers pretty much anything that doesn't work.

- The car feels good.

- The car looks good.

- Driving a new car makes you feel good.

- Driving exactly the car you want affirms your vision of your self.

- The hot mom drives a hot minivan.

- The successful tech exec drives a Tesla.

- The socially climbing go-getter drives a fast & tight luxury import.

The car companies are marketing masters. They have figured us out and they sell us our dreams and aspirations, they sell us the who we want to be. And it feels so good.

So what are the downsides of driving a new car?

DEBT

In addition to dreams and aspirations, the car companies sell us something else - they sell us debt. A lot of debt. In fact, car debt is usually in the top two or three categories of the debt carried by most Americans, right up there with college loans, credit cards and mortgages.

THE NUMBERS

According to CNN more than 100 million Americans have car debt, or more than 43% of the adult population. The amount that Americans have borrowed for their cars is $1.3 trillion. That's TRILLION with a "T". The average car payment, according to USA Today, is $531 per month. That may not seem like much if you have a good job, but that's $6,372 per year - much more than I paid for my hoopdie-mobile.

7,000,000 AMERICANS ARE 90 DAYS LATE ON THEIR AUTO LOANS

As I write this article several sources report that delinquency on auto loans is at an all-time high. Delinquency is defined as 90 days or more late. This development could just indicate that Americans are more confident in the currently booming economy than their paychecks justify. But it could indicate that the newest bubble is about to pop. Regardless 7,000,000 Americans are driving cars that they can not afford.

HOW TO BUY A CAR WITH CASH

And, as you'll see in the video below, with a little patience, you can easily save enough money to buy a very good used car with cash by never acquiring that $531 per month payment in the first place. And by instead depositing that $500 / month in your Free Car Money Tree account (or just by putting that car payment in a cookie jar) you can free yourself forever from the burden of a car payment.

And if you really start to see the big picture I'm painting here, you can direct that $500 per month into real assets that eventually make you very wealthy. More on that below.

According to analysis by credit agency Experian in 2018 "the average new vehicle loan hit a record high [of] $31,099, while the average loan for a used auto climbed to a record of $19,589."

So if you sucked it up for 3 years and paid yourself $531 every month [instead of paying a bank], you'd have enough to purchase a very nice used car worth $19,589. With cash. No loan. No interest. No payment. No debt.

A $20,000 car would still have many years left on its warranty. It would for all intents and purposes be new, except that some poor soul would have already taken the gigantic depreciation hit that all new cars suffer in their first two years.

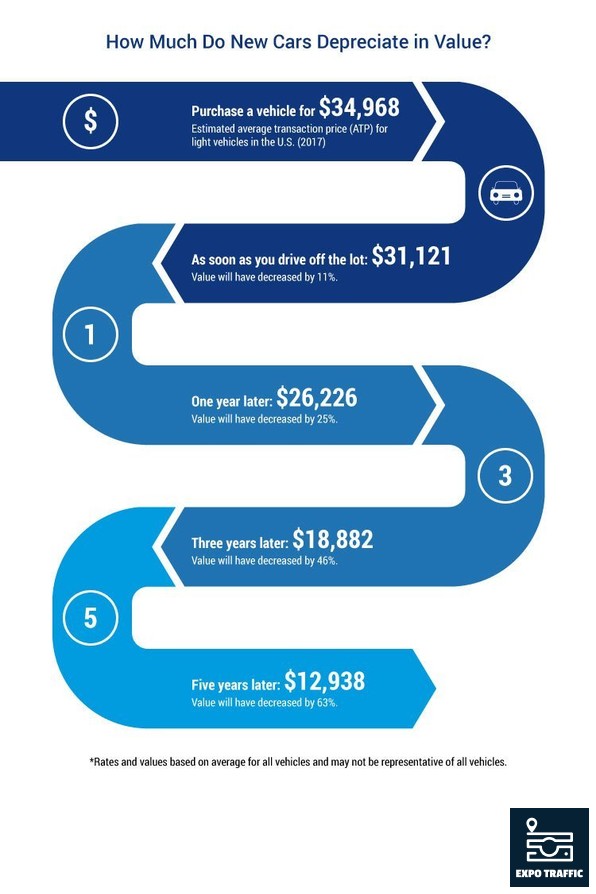

Just How Much Value Does A New Car Lose?

DEPRECIATION

According to a recent article on CARFAX "the value of a new vehicle can drop by more than 20 percent after the first 12 months of ownership. Then, for the next four years, you can expect your car to lose roughly 10 percent of its value annually. This means that a new car can be worth as little as 40 percent of its original purchase price after five years."

For a typical new car the value drops $6,000 the moment you drive it off the lot. Can you see yourself throwing stacks of $20 dollar bills into the air as you are pulling out of the dealership? If you buy a new car you should, because that's exactly what you're doing.

Slavery vs Freedom

SLAVERY

In my opinion the biggest reason most people should never buy a new car [the likes of Bill Gates excepted] is because it places us in a form of servitude to the banks, a literal kind of slavery.

For many workers a new car means that you are dragging a payment behind you that is one quarter of what you take home. One quarter of your life is devoted to paying for those big beautiful buildings the banks put up in nearly every city. Think of it: one week out of every 4 you are working for your new car, working for your bank.

Do you really want to buy another big building for your bankers?

Do you really want to buy these guys another building? Do you really want to devote one quarter of your life to making bankers even richer? When, with a little bit of sacrifice, you can drive the car of your dreams, while owing nothing to anybody. Free and clear in three years.

HOW TO DRIVE FREE CARS FOR LIFE IN 3 YEARS OR LESS

You want to know how you can drive free cars for life? Here's how.

Making the transition towards freedom

Let's say you kick the new car habit. What would you drive during those 3 humble years?

As the video above explains, you would start humbly by purchasing a hoopdie and saving a typical car payment for 10-12 months. After less then one year you could upgrade to a fairly nice car. For cash.

You can pick up a car that drives, that goes from A to B, that has seat belts and air bags, air conditioning and heat, decent tires and windshield wipers, for $1,000-$2,000. You can drop a brand new bluetooth enabled radio into the radio slot for under $300. You may need to occasionally drop $400 to fix a major system like the AC. But that's less than your friends in their sexy new cars pay every single month. Your monthly car payment is ZERO every month there are no major repairs, which in my experience is most months. And your insurance will be much lower than your friends' because your car isn't worth very much.

Gradual is good

FIRST YEAR - NO PAIN NO GAIN

Let's be honest. The first year is gonna be tough. Driving a $1,000 car takes some guts, because lots of strangers and your good friends will laugh at you. And lots of other people you don't know, and friends who maybe are not as good of friends as you thought they were, will look down upon your apparent poverty. They will feel sorry for you, or worse, for having to drive such a POS.

HOW DO I WEATHER THE MOCKERY AND CONTEMPT?

But you can handle this mockery and scorn because you hold secret knowledge. You know that you are getting ahead. You know that you are winning. You are choosing to create wealth. You know that nearly all of these people throwing you shade, disdain and laughter are drowning in car debt, wasting money on cars they can't afford to impress people they don't know.

When I see shiny new and expensive cars, I automatically see a huge anchor dragging behind that car and its owner. I feel sorry for them.

Once you've kicked the new car slavery habit, you don't have to remain in a hoopdie for very long. Because older cars have already lost most of their value, a hoopdie is still worth almost what you paid for it if you sell it, say, 12 months after you buy it.

So, if you pay $1,000 cash for your first hoopdie, and save $512 per month during those first difficult 12 months, you'll have over $6,000 in your piggy bank, PLUS you'll get close to $1,000 for your hoopdie when you sell it after driving it for only one year.

SECOND YEAR - from a $7,000 CAR to a $12,000 CAR

In your second year on the road to freedom you can pay $7,000 CASH for your second hoopdie ($6,000 in the piggy bank, plus the $1,000 from the sale of your first hoopdie). And you can end this 2nd year ready to pay cash for a $12,000 car.

Already you'll be driving a pretty nice car. Check out this list of used cars in the Las Vegas area priced under $7,000.

At the end of that second 12 month period, you'll have another $6,000 in the piggy bank, plus the $6,000+ you'll get by selling your second hoopdie. Can you buy a decent car for $12,000? Heck yeah! Check out all these used cars under $12,000.

THIRD YEAR - from a $12,000 SWEETIE PIE to an $18,000 HOTTIE

So you start your third year paying $12,000 cash for a pretty nice car, and you end the third year ready to pay $18,000 cash for a very nice car.

You're no longer driving hoopdies.

For $18,000 you can buy a very nice used car with most of its warranty still left.

Look at all these beautiful cars you can buy for under $18,000 with cash in 3 short years.

A nearly new car, for cash, in 3 years or less. Now that's smart.

WELCOME TO FREEDOM

MONEY TREE vs PIGGY BANK

In the examples above I've talked about merely putting that $512 monthly car payment all of your friends are chained to into a piggy bank.

But what about investing that money into a genuine ASSET, something that generates money all on its own? The money in a piggy bank does not grow - in fact it shrinks at the rate of inflation. And once inflation and fees are factored into the money you put into a savings account or most Wall Street mutual funds, they don't grow either, contrary to the advice from Dave Ramsey in the video above.

Buy & Hold Real Estate Is A Money Tree

But there are investments that consistently return 6% to 10% or even 12% on your money year after year. The one my family is pursuing is buy & hold rental properties that are slow appreciating but that generate consistent cash flow. Lots of podcasts, authors and websites go into this fascinating realm of wealth-building through cash flowing real-estate, but we have found the most useful information on the legendary Bigger Pockets website. All of their podcasts and web forums are free. If you invest the time you can learn a tremendous amount about cash-flowing real estate.

I've read almost everything Robert Kiyosaki has written, and I've listened to about 70 of the more than 300 podcasts up on Bigger Pockets. One of my real estate friends Alex Felice listened to every single podcast as he drove to and from school and he attributes his education - and his burgeoning real estate empire - to Bigger Pockets. If you want to learn lots about real estate investing and connect with a very connected guy, check out Alex's blog Broke Is A Choice.

Once you've cut that $500 per month anchor you've been dragging behind you, you're gonna need somewhere to invest all that money you've liberated so that you can begin creating real wealth through passive income.

THE BENEFITS OF DRIVING HOOPDIES

Near the top of this article I promised to talk about the less obvious benefits of driving hoopdies. Everybody loves the benefits of driving a new car. But there really are benefits to driving a hoopdie.

-

my hoopdie gets me from Point A to Point B in about the same time as other peoples' swagmobiles.

-

my hoopdie keeps me very humble, no matter how much money I earn, how beautiful my wife and kids are, how many properties I own, how awesome my life is.

-

by investing in real assets the $500-$900 my hoopdie does not cost me every month, my hoopdie is helping me create wealth instead of destroying wealth.

-

nobody is going to steal my car. nobody. I could park my car in the scariest neighborhood and I know it will still be there when I come out ready to drive to my next destination.

-

I could store gold bars in my trunk and nobody is going to break it open and look. Seriously.

- With functioning seat belts, air bags, crumple zones, good tires, AC and heat, my car is as safe and comfortable as most people's cars.

- WHY DRIVING A NEW CAR IS KEEPING YOU POOR - OR WHY I LOVE HOOPDIES

- WHY I DITCHED MY CANON SPEEDLITES & PROFOTO B1s

How to Get a Car When You Re Poor

Source: https://www.expotraffic.com/faqs/articles/driving-new-car-keeping-poor-love-hoopdies

0 Response to "How to Get a Car When You Re Poor"

Post a Comment